Total Transactions Processed

325M+

PROVEN ACCURACY

Netbasis will easily calculate your adjusted cost basis for all your Computershare manged holdings. We have your stock or mutual funds' history of corporate actions, pricing and dividends going back as far as 1925. Netbasis requires only a minimum amount of information from you to calculate your cost basis.

Netbasis will easily calculate your adjusted cost basis for all your Computershare manged holdings. We have your stock or mutual funds' history of corporate actions, pricing and dividends going back as far as 1925. Netbasis requires only a minimum amount of information from you to calculate your cost basis.

All you need are the purchase and sale dates and number of shares. Your Brokerage Firm, Transfer Agent or Company may be able to help you obtain that information. If you need help on how to collect that information, click here for helpful tips.

Enter the acquisition date(s) for the shares you acquired (purchased, inherited or received in a spin-off). Then enter the date(s) of shares you sold.

Enter the number of shares for every acquisition. Then enter the number of shares for every sale.

You don’t have to enter every dividend. Click “Yes” if you reinvested dividends for the entire holding period or enter the start or end dates.

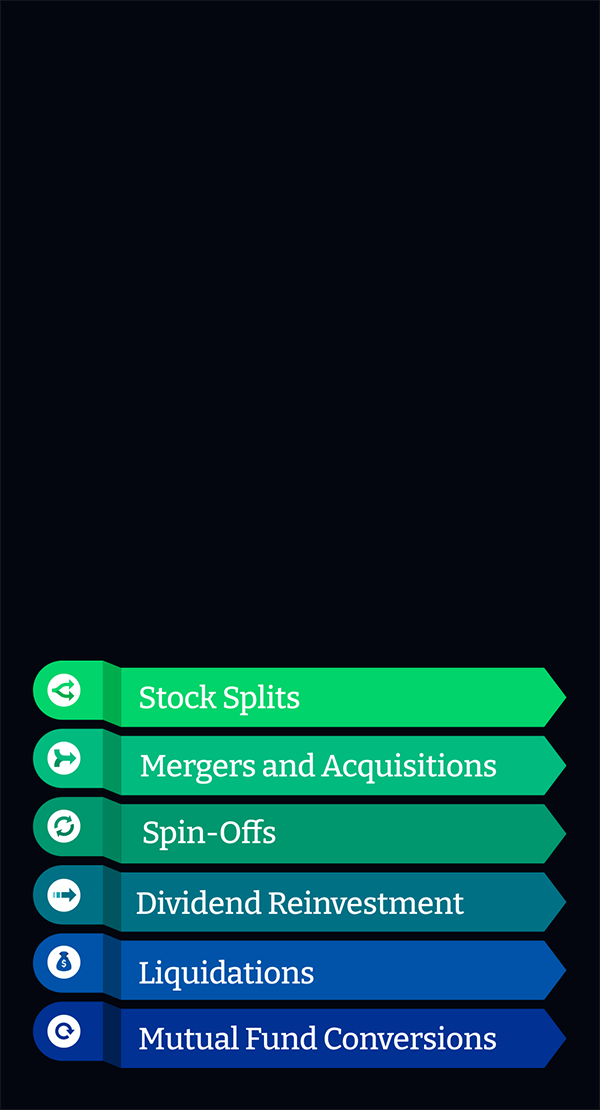

A Century of Complete Coverage

We have all

your security’s

corporate actions.

Netbasis is the only investment tax tool that can determine the historical cost basis of virtually any security going back as early as 1925. Our rich proprietary data and patented technology allows Netbasis to provide other key wealth management tools that are essential to our users.

A Century of Complete Coverage

We have all

your security’s

corporate actions.

Netbasis is the only investment tax tool that can determine the historical cost basis of virtually any security going back as early as 1925. Our rich proprietary data and patented technology allows Netbasis to provide other key wealth management tools that are essential to our users.

Netbasis has built a strong reputation over the last 25 years and has serviced more than 325 million transactions for its customers needing cost basis information and analysis. The success of client loyalty has been the direct result of Netbasis’ superior product offering and customer support that is used by leading financial institutions, transfer agencies, individual investors, tax preparation software companies, accounting firms, money managers, Fortune 500 companies, and financial planning professionals.

512 Bit

AES ENCRYPTION

325M+

PROVEN ACCURACY

25 Years

THE POWER OF RELIABILITY

115K+

EQUITY & DIGITAL ASSETS

Netbasis has the pricing and corporate events (splits, spin-offs, mergers, etc.) and dividends for your investment but we don’t have your personal investment information.

Netbasis has multiple features that can assist you when you don’t have all your purchase information, but you have to at least have a complete purchase date.

If you don’t have this information in your records, there are only three possible sources that may have your investment information:

1 . The company in which you own shares.

2. The transfer agency for the company in which you own shares.

3. Your brokerage firm.

When reaching out to any of these options, it is important to ask specifically for your investment history and not your cost basis. None of these entities are required to report your cost basis prior to 2011 on the 1099-B, so they will answer a question about cost basis accordingly. Asking specifically for the oldest date and number of shares in the records is a good place to start.

Yes, Netbasis will calculate the average price by taking the high and low prices from the purchase date into account, and then proceed to adjust for any corporate actions that have occurred.

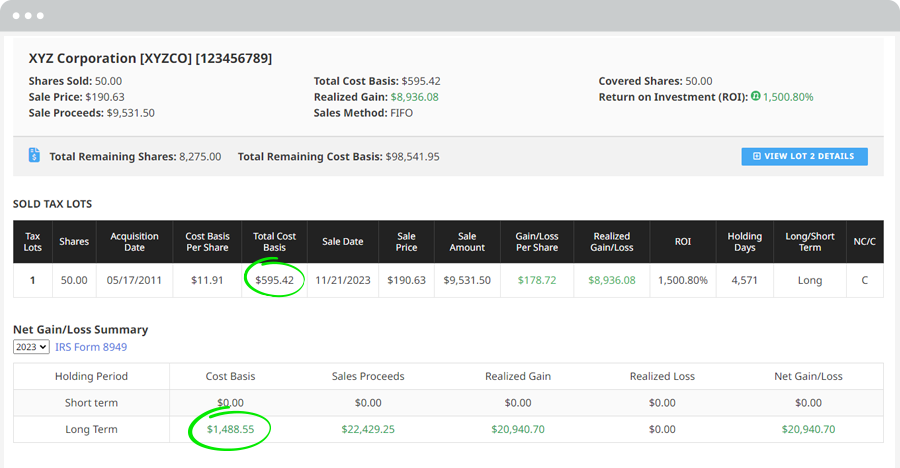

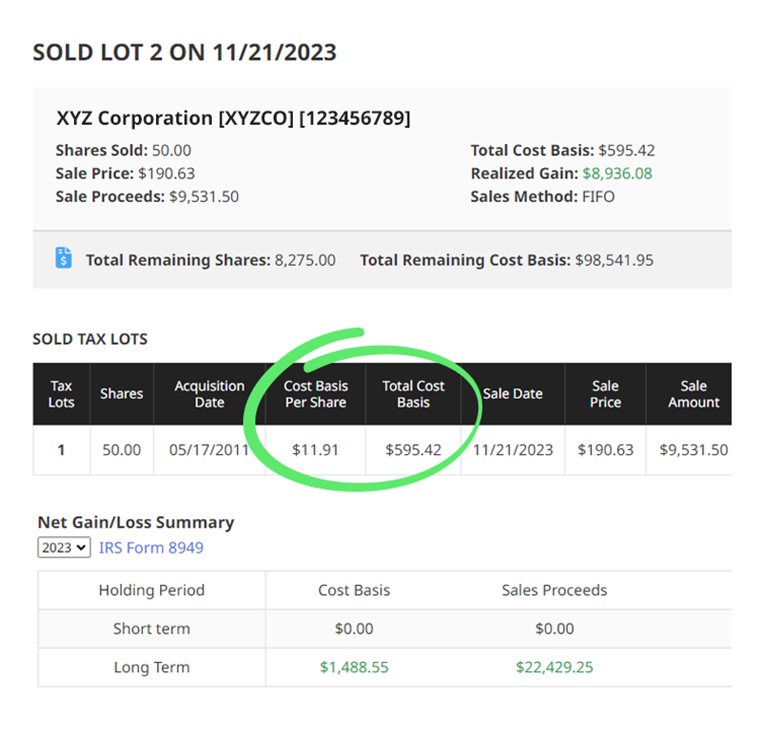

In the Summary section of the report, the adjusted cost basis (both per share and in total), the gains or losses for both long-term and short-term periods for covered and non-covered shares (detailed per share and in total), and the sale proceeds (per share and in total) are presented. Should there be a partial sale, information regarding the cost basis and the fair market value of the remaining shares is also included. The Detail section offers a comprehensive breakdown of all corporate actions and dividends (where applicable) that have been factored into the calculations, serving as essential documentation for personal records or for submission to a professional.

At the beginning of the report page, users can find the functionality to download the cost basis and profit/loss figures into a digital format for both the current and previous year's IRS Form 8949 and Form 1020 S (Schedule D).

A National Poll by Financial Planning Digest reported that over 90% of Certified Public Accountants still calculate cost basis manually when securities have an extensive history. Compare the difference in time and money saved when you choose Netbasis.

Come try Netbasis for yourself! You can freely search securities along with their CUSIP, ticker, start and end date. In addition you can try out all the features in our Trade Activities UI. If you need to save time and taxes, get a Netbasis full comprehensive cost basis report. We have price options ranging from single report up to unlimited usage. Experience the future in cost basis reporting & analysis.