Individual Investors

Netbasis can provide Answers to Investment Tax Issues

Netbasis generates a complete detailed report for your records.

Netbasis Featured Tools

Tax Loss Harvesting

The Netbasis Tax-loss Harvesting feature will first verify the cost basis accuracy on any existing security position(s). Second, Netbasis will provide custom simulated sale scenarios to reach an efficient tax loss harvesting strategy.

Wash Sale Loss & Detection

The Netbasis wash sale loss deferral feature is a “must have” tool. Users can quickly identify any of the 30 most complicated wash sale tax scenario violations in seconds.

Crypto, Equities, PTPs

The crypto tool can upload multiple transactions via CSV file and process multiple tokens simultaneously. Netbasis currently covers over 500 cryptocurrencies and updates its database daily.

Tax Sale Planning

Netbasis provides a tax sale planning tool that allows users to predetermine the right sale methodology decision before the actual sale. A detailed report identifying the specific tax lots required to achieve the desirable tax strategy.

Charitable Planning

Netbasis provides a charitable tax optimization tool that allows users to maximize their planned giving strategy by creating smart “what if” contribution tax saving simulations.

A Century of Complete Coverage

We have all

your security’s

corporate actions.

Netbasis is the only investment tax tool that can determine the historical cost basis of virtually any security going back as early as 1925. Our rich proprietary data and patented technology allows Netbasis to provide other key wealth management tools that are essential to our users.

A Century of Complete Coverage

We have all

your security’s

corporate actions.

Netbasis is the only investment tax tool that can determine the historical cost basis of virtually any security going back as early as 1925. Our rich proprietary data and patented technology allows Netbasis to provide other key wealth management tools that are essential to our users.

Investment Tax Management Tools

Netbasis is a first of its kind versatile platform that allows advisors to access several wealth tax analytical tools in the area of:

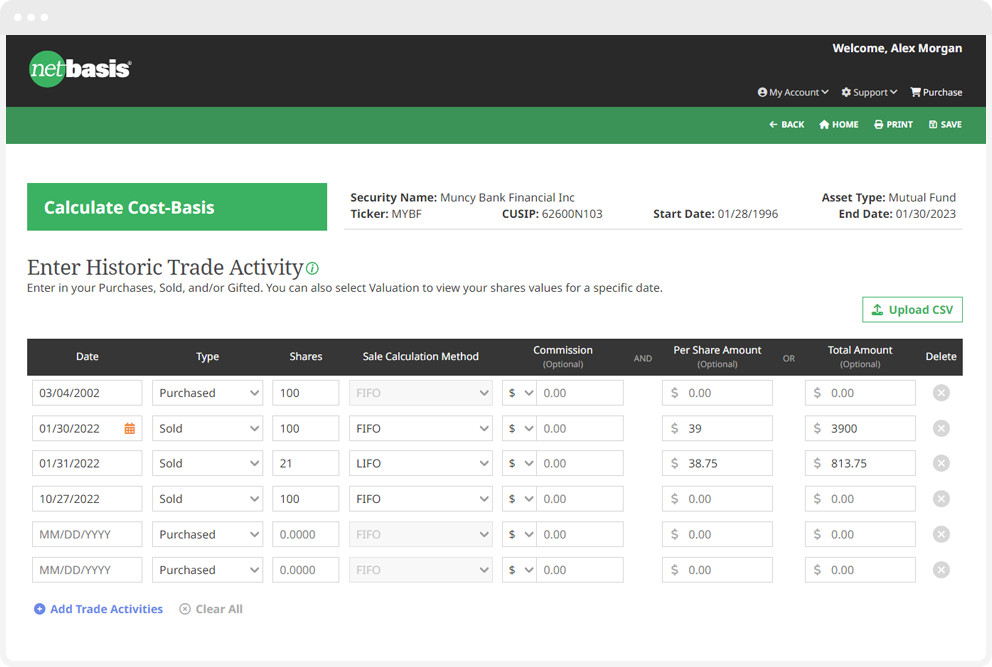

Common Equities & Mutual Funds

Netbasis is the only investment tax tool that can determine the historical cost basis of virtually any security going back as early as 1925. Our rich proprietary data and patented technology allows Netbasis to provide other key wealth management tools that are essential to our users. What makes the Netbasis so effective all starts with an accurate cost basis, which in turn is the necessary starting point to produce real and individualized results when making smart tax strategy and planning decisions.

Additional Cost Basis Functionality

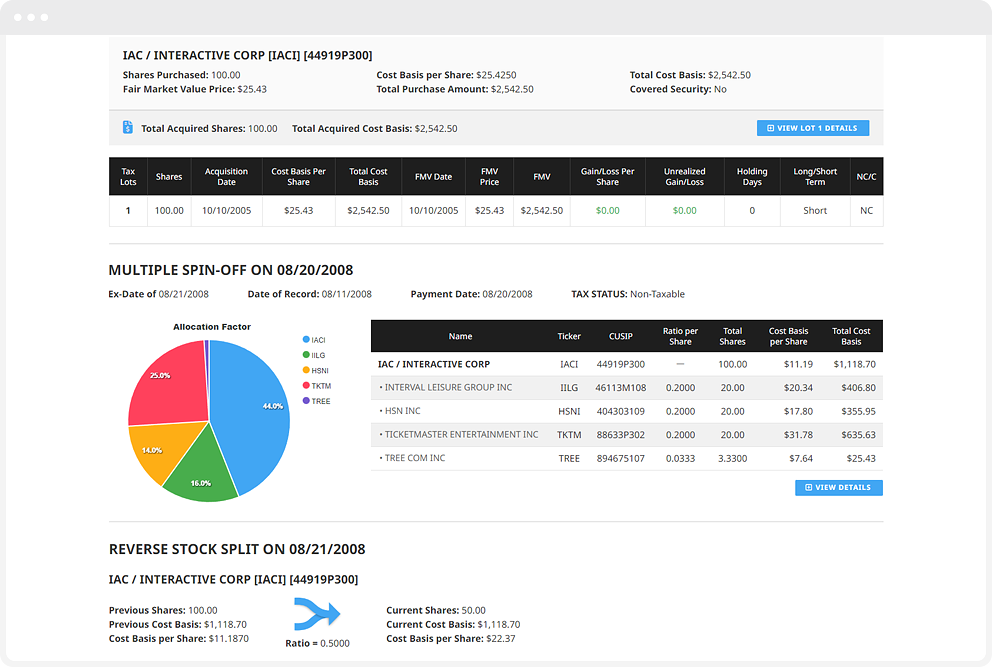

- Tax Lot Accounting: Every full and/or fractional purchases and sales are treated as tax lots.

- Complete Adjust Cost Basis: Provides both adjusted cost basis totals and per share results.

- Share Adjustments: Provides the adjusted number of shares based on corporate action events.

- Remaining Shares: Calculates the cost basis of any remaining shares held to date.

- No Effect Mergers: Provides corporate merger information even when it does not affect the basis.

- Dividend Reinvestment: Calculates each dividend reinvestment made during the holding period.

- Systematic Investments: Calculates each systematic purchase made during the holding period.

- Systematic Withdrawals: Calculates each systematic sale made during the holding period.

- Forward Tracker: Identifies the survivor when a purchase date is after the start date available.

- Back Tracker: Identifies the predecessor when a purchase date is before the start date available.

- Equity Mapping: Identifies the family tree of parent and spin-off companies in a single view.

- Spin Off Tracker: Follows the selected spin-off company from the parent to a chosen end point.

- Return of Capital: Calculates the adjusted cost basis with return of capital dividend payments.

- Display Dividends: Displays all dividend payment information received during a holding period.

How can this feature help me?

The Cost Basis tool can be highly effective for missing cost basis information or existing cost basis information that needs to be verified. This cost basis tool will accurately calculate gain/loss, properly allow for all different sales methods (FIFO, LIFO, LOFO, HIFO, etc) and auto-populate your trade information on the 8949 and Schedule D tax forms. Netbasis is the right tool when making important investment planning and tax strategy decisions.

It all starts with your Netbasis!

Networth Products & Services Featured in

Some of our Awards and Recognitions