The cryptocurrency and digital asset market has seen exponential growth in recent years, attracting millions of investors worldwide. However, with great opportunities come significant responsibilities, particularly when it comes to taxation. The recent implementation of new tax regulations surrounding the sale of...

What's Trending

The day you buy or sell a security is the trade or transaction date. The settlement date is the official day that shares are transferred to a buyer’s account or money is transferred to a seller’s account. Since 2017, the time period between the transaction date and settlement date has been two business days or T+2.

A capital loss occurs when an investment, such as a stock or bond, is sold for less than its original purchase price, reflecting a decrease in the investment's value. Experiencing capital losses is a common aspect of the financial markets and is part of the investing process. These losses can affect your taxes...

Whenever you realize a profit from selling an investment at a higher price than itspurchase cost, it’s necessary to assess and report potential capital gains taxes on your tax return. This applies to any asset, including stocks, mutual funds, and cryptocurrencies sold for a gain will obligate you to calculate...

Unfortunately, a large number of investors receive 1099-B forms that only provide a portion of the investment information needed to complete the IRS Capital Gains & Losses, Schedule D form. The adjusted cost basis is provided for "covered" securities, but the "non-covered" securities section is blank.

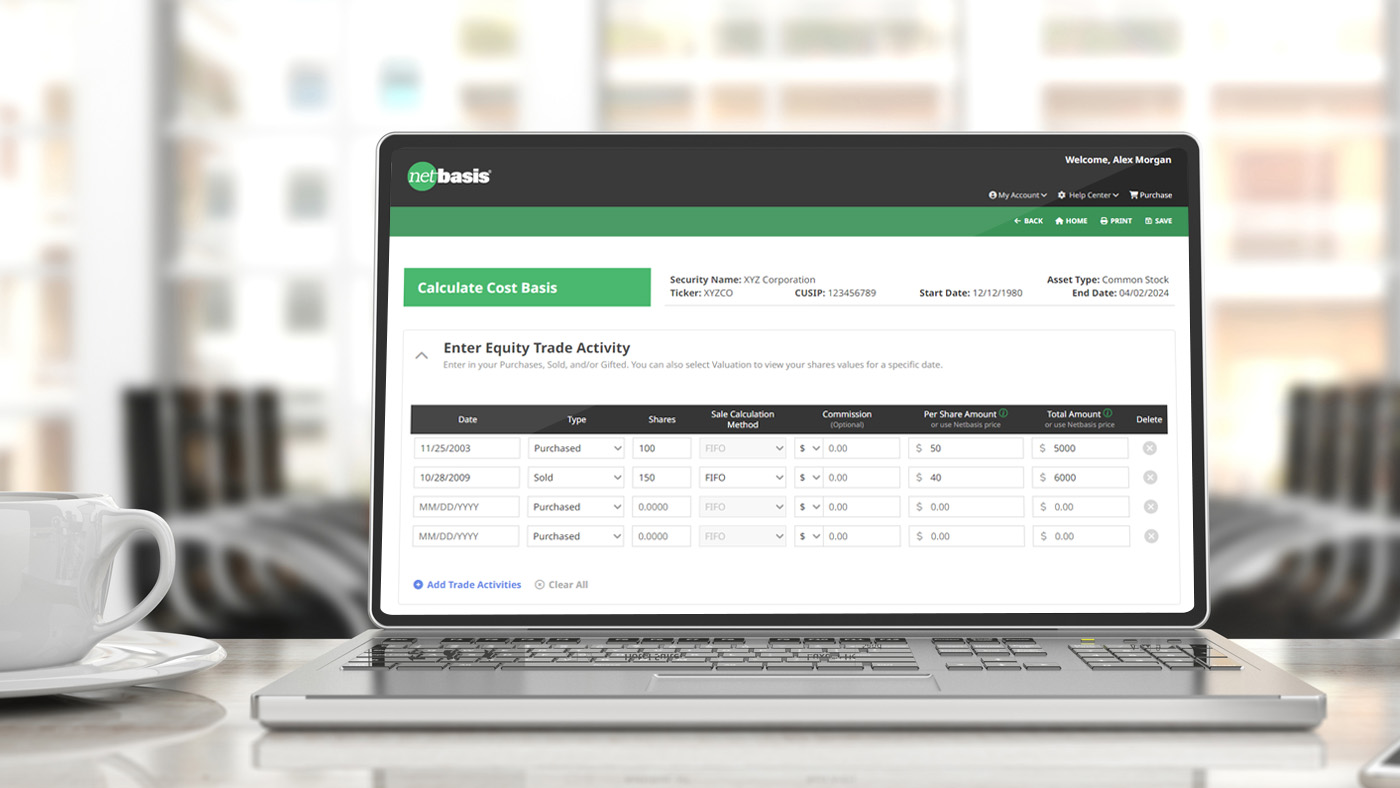

Correctly calculating the adjusted cost basis of tax reporting can be very daunting task for many investors. It is critical factor in determining the capital gains taxes owed or the losses or deductions that can be taken for the sale of stock, mutual fund or other investment.